The funny thing about trends is that they can take quite a long time to become boring and traditional. If you are living through a major trend – the way we are living through the birth and widespread adoption of cryptocurrency – it can begin to look tawdry.

It’s as if we went from a neon-lit, live music infused dive bar blowout and instead of letting sleeping dogs happily lie, we went back in the bright light of the afternoon to witness just how grimy and gross that dive bar really is.

Cryptocurrency had its debut glamour party – but has hung around and tried to keep up the hype, leaving many people like me feeling ambivalent about it.

That is, until Aspire Research Group researcher and writer extraordinaire, Elisa Shoenberger, pointed me to the Harvard Business Review (HBR) article, What Skeptics Get Wrong About Crypto’s Volatility.

Elisa has been known to quote John Taylor, a fundraising operations consultant, who can talk about how he had to coax reluctant nonprofits that credit cards were safe and that they really needed to accept credit card donations. Now we are coaxing reluctant nonprofits to accept cryptocurrency. Given the volatility, is that wise?

The HBR article talks about how cryptocurrency is a young industry and how its liquidity and transparency act as bright sunlight does in that dark and grimy dive bar. It also describes investor mentality in startup ventures. Most early investors recognize that usually a small percentage of those startup investments will yield a return, although hopefully there will be at least one with a BIG return.

When we begin to view cryptocurrency through the lens of a startup investor, all that volatility and wild west behavior begins to feel less chaotic and more like a toddler tantrum. It’s unpleasant and can cause some damage but is easy to put into a box (or a playpen) to control the damage.

As Elisa likes to say, don’t invest more than you can afford to lose. (It’s gambling folks!)

And don’t forget why and how the Securities and Exchange Commission (SEC) was created. There was a time when the industry of publicly company trading had extreme volatility and fraud. The SEC was created to regulate and protect the public.

Public company trading is definitely boring and traditional compared to cryptocurrency!

Is Cryptocurrency property, a security, or a commodity?

Will there be a new agency created to regulate cryptocurrency and protect the public? I doubt it. The scuffle for regulatory control is likely to happen between the SEC and the Commodity Futures Trading Commission (CFTC).

The Internal Revenue Service (IRS) has already ruled that it considers cryptocurrency to be property. This matters when a cryptocurrency is gifted, for example.

But what about whether it is a security or a commodity?

A security produces a return from an entity or company. A commodity is a “basic good” that you can buy, trade, or exchange – like food or electricity.

People have certainly been trading cryptocurrency for return, but is it really a security? Currency might be considered a commodity, but does cryptocurrency qualify as a “basic good”?

The scuffle has indeed begun! And that’s just part and parcel of a young industry.

This constant tussling over definitions, uses, and abuses is also what makes it difficult to keep up with what is trending in cryptocurrency and philanthropy.

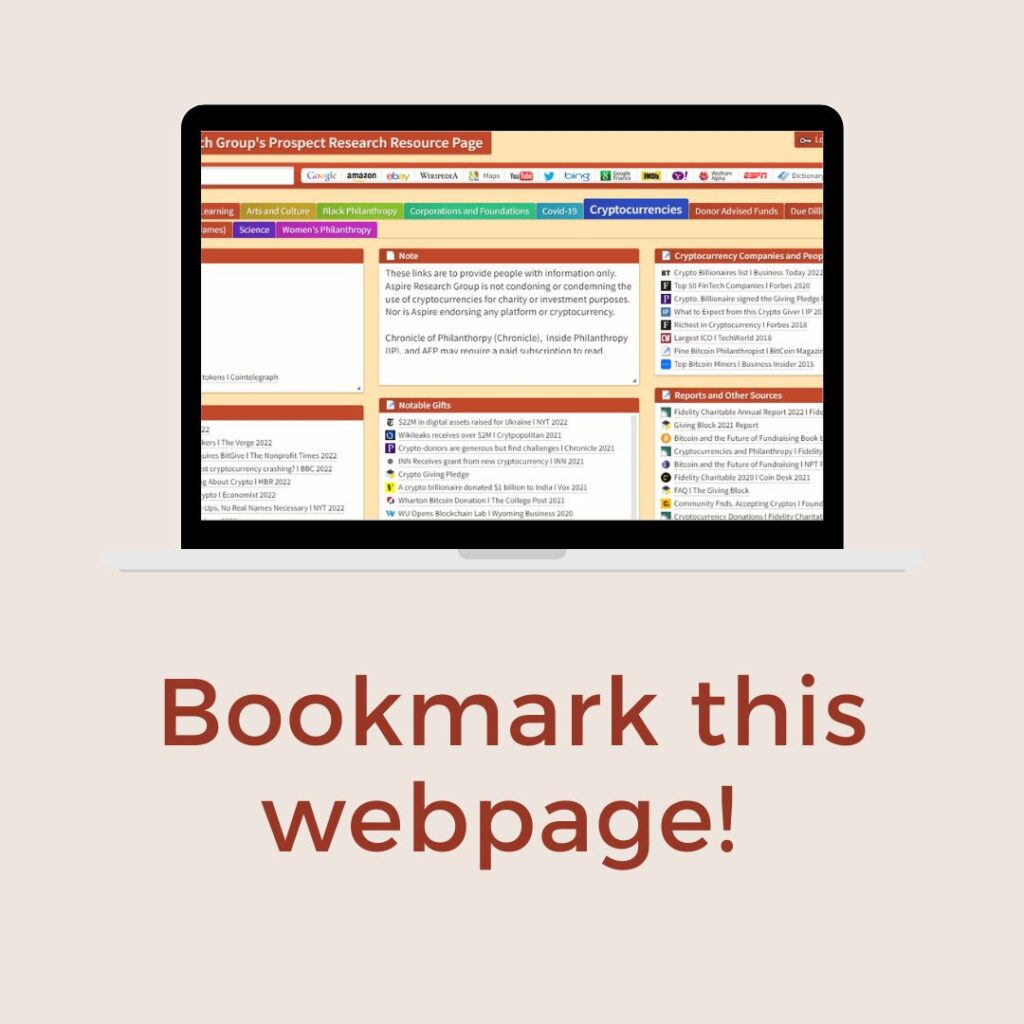

Lucky for you, Elisa Shoenberger has compiled and kept current a well-curated list of resources related to cryptocurrency and fundraising!

Bookmark the webpage and you instantly have a library of relevant cryptocurrency resources at your mouse click:

https://www.protopage.com/prospectresearch#Cryptocurrencies