It’s no secret that nonprofit fundraising success relies heavily on strategic data tracking. By collecting and analyzing information on your campaigns and donors, you can identify strengths and areas for improvement in your fundraising strategy so you can hone your efforts going forward.

Tracking your nonprofit’s financial data has a similar purpose—to help you evaluate your organization’s situation and determine the best next steps to take for improved operations and sustainability. However, accurate financial reporting is also essential to ensure compliance with legal requirements for nonprofits.

To help you achieve both of these goals, this guide will cover four tips for effectively tracking your nonprofit’s finances, including how to:

- Use the Accrual Accounting Method

- Leverage Dedicated Accounting Software

- Categorize Expenses by Function

- Work With a Nonprofit Bookkeeper

As you implement these tips at your organization, remember that financial management works alongside fundraising to further your mission. While you might track some aspects of these activities separately, compare the data to check that both processes are aligned with each other and with your nonprofit’s overall goals. That being said, let’s dive in!

1. Use the Accrual Accounting Method

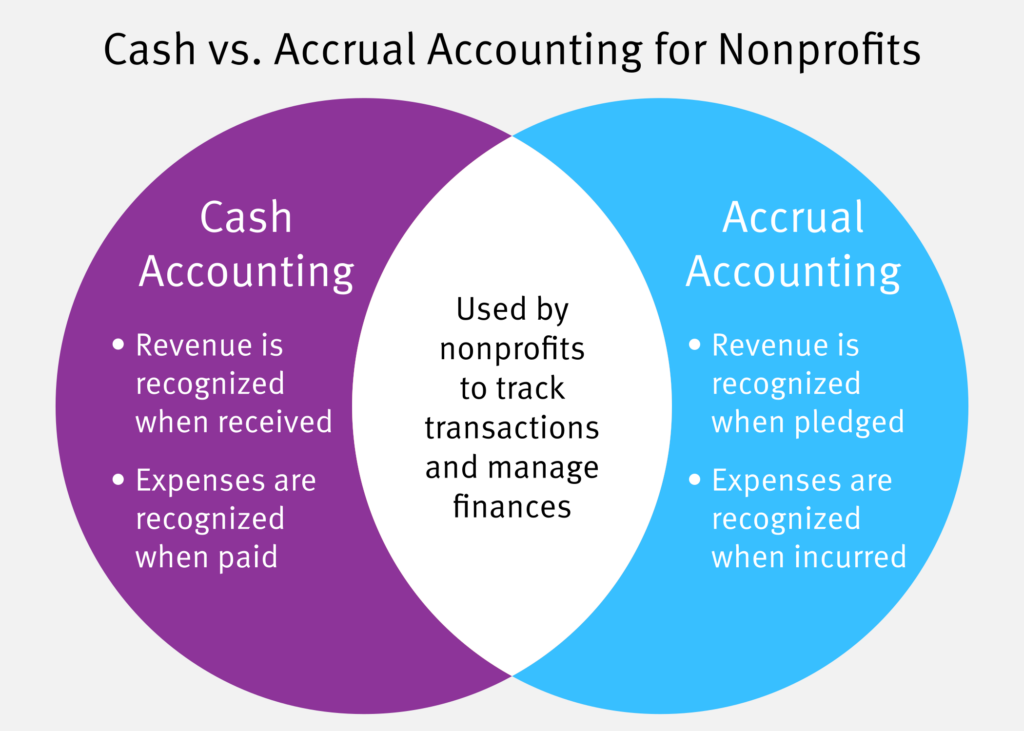

Standardizing financial data entry allows for more accurate results and improved decision-making. However, there are two methods your nonprofit can use to track its finances: cash accounting and accrual accounting. Jitasa’s guide to cash vs. accrual accounting explains the differences between the two as follows:

- In a cash accounting system, your nonprofit recognizes revenue when it’s received and expenses when they’re paid. For example, if you’re planning a fundraising event with a peer-to-peer component, you’ll wait to record the pledges your supporters collect through their individual fundraising pages until you get the funding. Additionally, if you put down a deposit for an event supply rental and then pay the rest upon pickup, you’ll record the deposit and the outstanding balance as separate expenses.

- With accrual accounting, your organization recognizes revenue when it’s pledged and expenses when they’re incurred. For our peer-to-peer fundraising event example, you’ll record pledged donations as your supporters collect them and log the entire cost of the supply rental when you put down the deposit since you’ve promised to pay the full amount.

Many nonprofits start out using the cash accounting system because it’s generally easier to navigate. However, as soon as your organization’s finances become more complicated, you should switch to accrual accounting. This method makes it much easier to track your organization’s financial commitments in addition to tangible transactions, providing a complete picture of your situation.

2. Leverage Dedicated Accounting Software

To effectively implement an accrual accounting system, you’ll need to leverage the right tools. While you might have started out tracking your transactions in a spreadsheet, a dedicated accounting solution will give you the bandwidth to organize and analyze more complicated data, such as:

- Fixed asset values (e.g., any buildings or vehicles your nonprofit may own)

- Accounts payable and receivable

- Loans, lines of credit, or other debts

- Restricted funds (e.g., major or planned gifts that a donor has designated for a specific initiative)

- Grant progress and reporting requirements

Most accounting platforms also allow you to store your budgets, financial statements, tax returns, and other key documents in one place for easy access. While not all of the best solutions are specifically designed for nonprofits, make sure to choose one that you can configure for your organization’s needs.

3. Categorize Expenses by Function

In your accounting software, the best way to categorize your revenue is by source. For instance, you might have sections to store data on individual donations, corporate philanthropy, earned income, grants, and investment returns.

On the flip side, there are two ways you could organize expense data. Although categorizing based on the nature of payments made (staff salaries, software fees, office equipment purchases, etc.) is more straightforward, the more effective method is to categorize based on how each expenditure functions in relation to your mission. Not only do these functional expense categories better reflect how your spending furthers your cause, but they also align with reporting requirements for nonprofits.

The three categories of functional expenses are as follows:

- Program costs are directly related to your organization’s mission and vary widely from nonprofit to nonprofit. For example, an animal shelter would put the costs of food and veterinary care for their rescue pets under their program expenses, while an environmental organization might put the costs associated with setting up community composting stations under theirs.

- Administrative costs are necessary to run your organization day-to-day. They include expenses such as staff compensation, utility bills, and purchases of office supplies.

- Fundraising costs are the upfront expenses associated with revenue-generating campaigns. They include spending on event planning, marketing materials, and specialized fundraising software.

While administrative and fundraising costs aren’t inherently bad—as mentioned above, having some of these expenses is essential for your nonprofit to thrive—your organization’s goal should be to increase the amount of funding you put toward your programs within reason. If you find yourself needing to cut costs, try to reduce spending on administrative and fundraising activities before you consider taking any funds away from your programs.

4. Work With a Nonprofit Bookkeeper

To ensure consistent tracking of all types of revenue and expenses in your accounting system, designate one person to take the lead on your organization’s financial recordkeeping (also known as nonprofit bookkeeping) This individual—your bookkeeper—will primarily be responsible for:

- Entering transaction data

- Writing checks

- Making bank deposits

- Managing invoices

- Allocating functional expenses

- Processing payroll (according to NXUnite, this duty may either fall to your bookkeeper or your human resources professionals depending on your nonprofit’s structure)

If your nonprofit is on the smaller side, you can assign bookkeeping duties to a staff member with financial knowledge or ask a trusted volunteer to fill the role. However, as your organization grows, you’ll either need to hire a full-time bookkeeper or leverage outsourced bookkeeping services to have access to the expertise you need for effective financial data tracking.

If you track your nonprofit’s financial data effectively, you’ll have a wealth of information to inform your goal-setting, budgeting, cash flow forecasting, financial statement creation, tax filings, and a variety of other essential financial management tasks. Leverage your accounting software and consult with nonprofit finance professionals to ensure you’re making the most of your data—not just for compliance, but also for serving your community.

Author: Jon Osterburg has spent the last nine years helping more than 100 nonprofits around the world with their finances as a leader at Jitasa, an accounting firm that offers bookkeeping and accounting services to not for profit organizations.