By Erica Sauer

Wealth Tiers and Asset Allocation Models Aid Research

This year in 2018, Aspire introduced its Tactical Briefings and Strategic Assessments. These profiles estimate net worth, assign a wealth tier, and project asset allocations.

This year in 2018, Aspire introduced its Tactical Briefings and Strategic Assessments. These profiles estimate net worth, assign a wealth tier, and project asset allocations.

The thread tying everything together is estimated net worth. Net worth is defined as assets minus liabilities. Because liabilities such as debts are private and not all assets are public, we can only estimate net worth. Although estimated, it’s still a helpful tool because the visibility of public assets tends to diminish with wealth.

Wealth Tiers

| Wealth Tier | Net Worth Low | Net Worth High |

| Working | $1 | $199,999 |

| Affluent | $200,000 | $999,999 |

| HNW | $1,000,000 | $4,999,999 |

| VHNW (very HNW) | $5,000,000 | $29,999,999 |

| UHNW (ultra HNW) | $30,000,000 | $99,999,999 |

| Elite | $100,000,000 | $999,999,999 |

| Billionaire | $1,000,000,000 | And up |

Aspire created its wealth tiers to make our research more efficient by understanding what’s typical. We estimate a prospect’s net worth and place him or her in the appropriate wealth tier. In its World Wealth Report, Capgemini defines high net worth (HNW) as US$1 million or more. We felt that further classification better represented differences in wealth and giving behavior at various levels of wealth.

At the Working, Affluent and HNW Tiers, real estate serves as the key asset. At VHNW, UHNW, Elite and Billionaire Tiers, the key asset shifts to business interests. Additionally, data from the 2016 Federal Reserve Survey of Consumer Finances describes Working and Affluent tiers, where a personal vehicle and residence represent most of the assets.

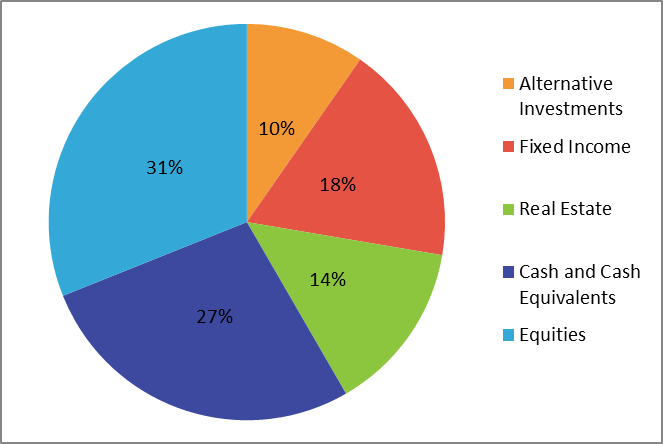

HNW Asset Allocation Model

Aspire adds asset allocation projections directly from Capgemini’s report, where it provides a breakdown of financial assets. Once we estimate net worth at the HNW or above wealth tiers, we apply the asset allocation model to reveal a prospect’s liquidity. Although imperfect, this asset allocation model meets the demands of fundraisers to have a better understanding of a prospect’s likely ability to make an immediate gift.

What Can I Do With the Result?

- If you are an Aspire client, you can now understand at a glance how your prospect sits relative to her wealthy peers. You can use the wealth tiers and asset allocation model as guides. How does what you know about the prospect fit neatly into or deviate from what you know about a wealth tier or the typical asset allocation?

- As you seek to differentiate the VHNW and above wealth tiers, recognize that you are looking to identify additional income and assets beyond earned income and real estate as well as different giving behaviors. You might identify multiple business interests, exclusive private banks (always check the bank name on the check), private foundations and other sophisticated giving vehicles, among other indicators.

Additional Resources

- World Wealth Report | Capgemini | 2017

- Chart: What Assets Make Up Wealth? | Visual Capitalist | 2018 (Source data 2016)

- The Hierarchy of “The Rich” in the United States | Joshua Kennon | 2010

1 thought on “Aspire Introduces Wealth Tiers and Asset Allocation Model”